How To Become a Chartered Accountant (CA): A Complete Guide (2025)

If you have a passion for numbers, an analytical mindset, and a drive for excellence, becoming a Chartered Accountant could be your pathway to success.

The world of finance is evolving rapidly, and in 2025, Chartered Accountants (CAs) are more in demand than ever before. With businesses expanding globally, governments tightening financial regulations, and digital transformations reshaping industries, the role of a CA is both challenging and rewarding.

If you have a passion for numbers, an analytical mindset, and a drive for excellence, becoming a Chartered Accountant could be your pathway to success. But how do you become one? What skills do you need? What career opportunities are available?

This guide will walk you through everything you need to know to become a Chartered Accountant in 2025.

This blogpost includes:

- What does a Chartered Accountant do?

- How to become a Chartered Accountant?

- Skills for a Chartered Accountant

- What do Chartered Accountant qualifications mean?

- Need of Chartered Accountant in different industries

- Who can become a Chartered Accountant?

- Salary Scope of Chartered Accountant in India

- Interview questions for Chartered Accountant

What Does a Chartered Accountant Do?

A Chartered Accountant (CA) is a highly qualified professional responsible for managing financial records, auditing accounts, preparing tax returns, and offering financial advice to individuals, businesses, and government organizations. Unlike regular accountants, CAs undergo rigorous training and exams to gain expertise in complex financial matters.

Key Responsibilities of a CA:

Auditing & Assurance – Reviewing financial statements to ensure accuracy and compliance with laws.

- Taxation – Advising on tax planning, compliance, and filing tax returns.

- Financial Management – Managing budgets, financial forecasting, and risk assessment.

- Advisory Services – Helping businesses with investment strategies, mergers, and acquisitions.

- Regulatory Compliance – Ensuring companies follow financial and corporate laws.

- Forensic Accounting – Investigating financial frauds and irregularities.

- Investment Analysis – Advising companies on stock market investments and wealth management.

In 2025, CAs are also leveraging artificial intelligence (AI) and automation tools to streamline processes, making their work more efficient and data-driven.

How to Become a Chartered Accountant?

Becoming a CA requires dedication, academic excellence, and passing rigorous examinations. Here’s a step-by-step guide:

Step 1: Meet the Eligibility Criteria

To begin your journey, you must have completed 10+2 (Class 12) with a recognized educational board. Students from Commerce, Science, or Arts backgrounds can apply, but having a Commerce background is beneficial as it provides foundational knowledge of accounting and finance.

Step 2: Register for the CA Foundation Course

This is the entry-level exam conducted by The Institute of Chartered Accountants of India (ICAI).

- You must register at least four months before the exam date.

- Subjects include Accounting, Business Laws, Economics, and Quantitative Aptitude.

- The exam is conducted twice a year, in May and November.

Step 3: Pass the CA Foundation Exam

The exam consists of both objective and subjective questions.

- Minimum passing marks: 40% in each subject and 50% aggregate.

Step 4: Enrol in the CA Intermediate Course

Once you pass the Foundation level, you must register for the CA Intermediate course.

- This stage consists of two groups with eight subjects covering financial reporting, corporate laws, taxation, cost accounting, and auditing.

- You must pass both groups to proceed further.

Step 5: Complete a 3-Year Articleship Training

Articleship is practical training under a practicing CA.

- This is a mandatory three-year internship where you gain real-world experience.

- You can only register for the CA Final course after completing at least 2.5 years of articleship.

Step 6: Register for the CA Final Course

This is the last level of the CA journey.

- The CA Final has two groups with eight subjects, including Financial Reporting, Strategic Financial Management, Advanced Auditing, and Direct Tax Laws.

- You must also complete the Advanced Integrated Course on Information Technology (AICITSS) before the final exam.

Step 7: Pass the CA Final Exam & Become a Member of ICAI

The CA Final exam requires at least 40% in each subject and 50% aggregate to pass.

- Once you clear it, you can apply for ICAI membership, receive your CA certification, and officially become a Chartered Accountant.

Skills Required for a Chartered Accountant

Being a CA is not just about passing exams; it requires a combination of technical expertise and soft skills.

Technical Skills:

- Accounting & Financial Knowledge – Strong grasp of IFRS, GAAP, and financial principles.

- Taxation & Auditing – Expertise in income tax, GST, corporate tax, and audit procedures.

- Analytical Thinking – Ability to analyse financial data and make strategic decisions.

- Tech-Savviness – Familiarity with AI-driven accounting tools, ERP software, and financial modelling.

Soft Skills:

- Problem-Solving Abilities – Identifying and resolving financial challenges.

- Communication Skills – Explaining complex financial matters in a simple way.

- Attention to Detail – Precision is key in financial reporting and auditing.

- Ethical Integrity – Maintaining transparency and adhering to financial regulations.

What Do Chartered Accountant Qualifications Mean?

There are multiple CA qualifications across the world, and each one has a different recognition level.

- CA (India) – ICAI (The Institute of Chartered Accountants of India)

- CPA (USA) – AICPA (American Institute of Certified Public Accountants)

- ACCA (UK) – Association of Chartered Certified Accountants

- CIMA (UK) – Chartered Institute of Management Accountants

- CA (Canada) – CPA Canada

While ICAI’s CA qualification is recognized in India, some CAs also pursue CPA, ACCA, or CIMA to explore international career opportunities.

Need for Chartered Accountants in Different Industries

A CA is not limited to working in audit firms or tax consultancies. Today, they are needed across multiple industries.

- Corporate Finance – Managing financial statements and regulatory compliance.

- Banking & Investment – Handling risk management and financial modelling.

- E-Commerce & Startups – Managing revenue models and taxation strategies.

- IT & AI Companies – Implementing AI-driven financial automation.

- Government & Public Sector – Working with financial policy-making and budgeting.

- Forensic Accounting & Fraud Detection – Investigating financial crimes.

With the rise of fintech and digital payments in 2025, CAs play a crucial role in shaping the future of finance.

Who Can Become a Chartered Accountant?

Anyone with a passion for finance and numbers can pursue a CA career, provided they:

- Are disciplined and hardworking

- Have strong analytical and logical skills

- Are ready to commit to a long yet rewarding process

- Are comfortable with financial regulations and taxation

Many students start their CA journey right after Class 12, while some pursue it after graduation. Working professionals can also switch careers by taking up the CA course.

Salary Scope of a Chartered Accountant in India

The earning potential of a Chartered Accountant (CA) in India is highly attractive, making it one of the most sought-after professions in the finance sector. The salary of a CA depends on various factors such as experience, skills, industry, and location. A fresh CA, right after clearing the final exams, can expect a starting salary ranging from ₹7-10 lakh per annum, especially if recruited by a top-tier firm or a multinational corporation. CAs working in Big 4 accounting firms—Deloitte, PwC, EY, and KPMG—often receive competitive packages, with some exceptional candidates securing salaries of ₹20-25 lakh per annum.

For mid-level professionals with 5-10 years of experience, salaries range between ₹12-25 lakh per annum, depending on their expertise in taxation, auditing, or financial consulting. Senior-level CAs, particularly those in leadership roles such as Chief Financial Officer (CFO), Finance Director, or Audit Head, can command salaries upwards of ₹50 lakh to ₹1 crore per annum.

Apart from job roles in companies, many CAs prefer to start their own practice or consultancy, where earnings can be unlimited based on their client base and expertise. Industries such as banking, fintech, investment firms, e-commerce, and IT companies actively seek skilled CAs, leading to higher salary growth. Additionally, CAs with international certifications like CPA (USA) or ACCA (UK) can explore overseas opportunities with even higher salary prospects.

With increasing demand for financial experts and compliance specialists, the salary growth for CAs in India is expected to remain strong in 2025 and beyond. If you're considering a career in Chartered Accountancy, rest assured that the financial rewards are as promising as the professional opportunities.

Interview Questions for Chartered Accountants

Once you become a CA, you will face technical and behavioural interview questions. Here are some commonly asked ones:

Technical Questions:

- Explain the difference between GAAP and IFRS.

- How do you handle tax audits and compliance?

- What are deferred tax liabilities?

- What accounting software are you proficient in?

- Explain cash flow vs. profit.

Behavioural Questions:

- Describe a challenging audit you worked on.

- How do you ensure accuracy in financial statements?

- How do you handle tight deadlines and pressure?

- Can you give an example of a time you identified a financial risk?

- What motivates you to be a Chartered Accountant?

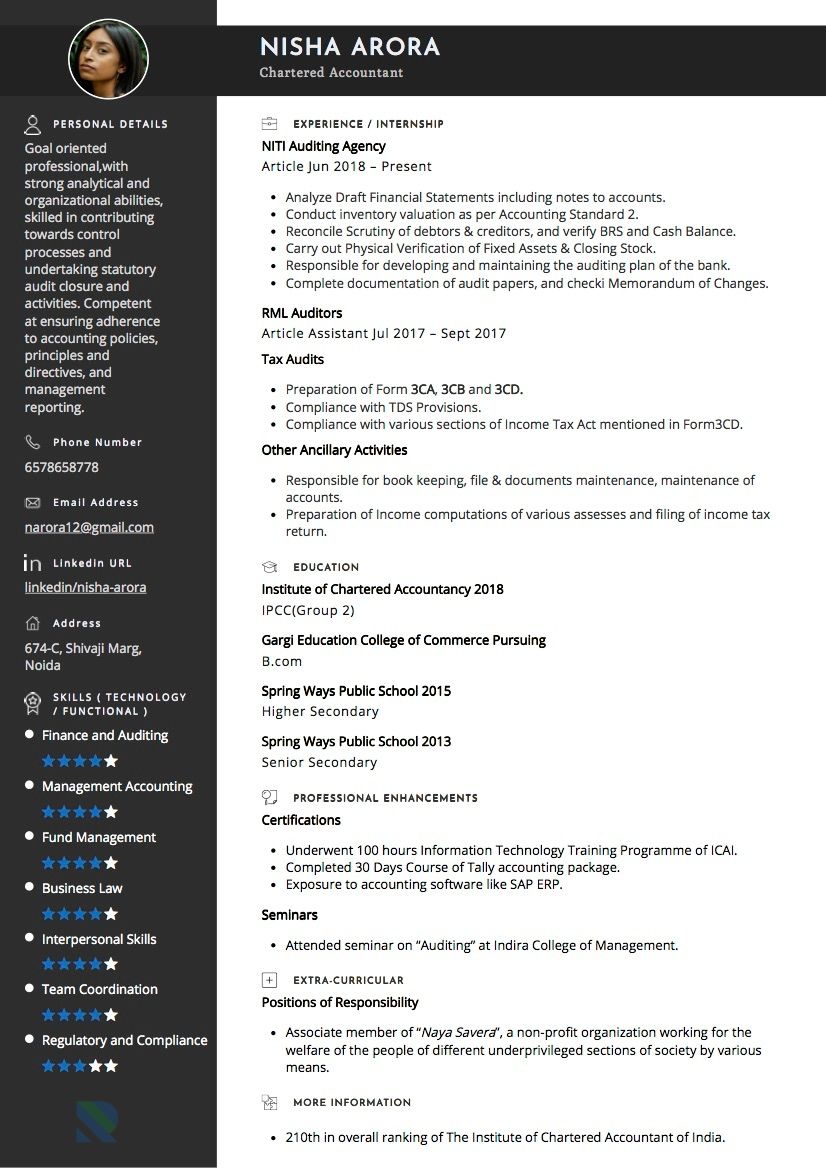

Top Rated Chartered Accountant Resumes on Resumod

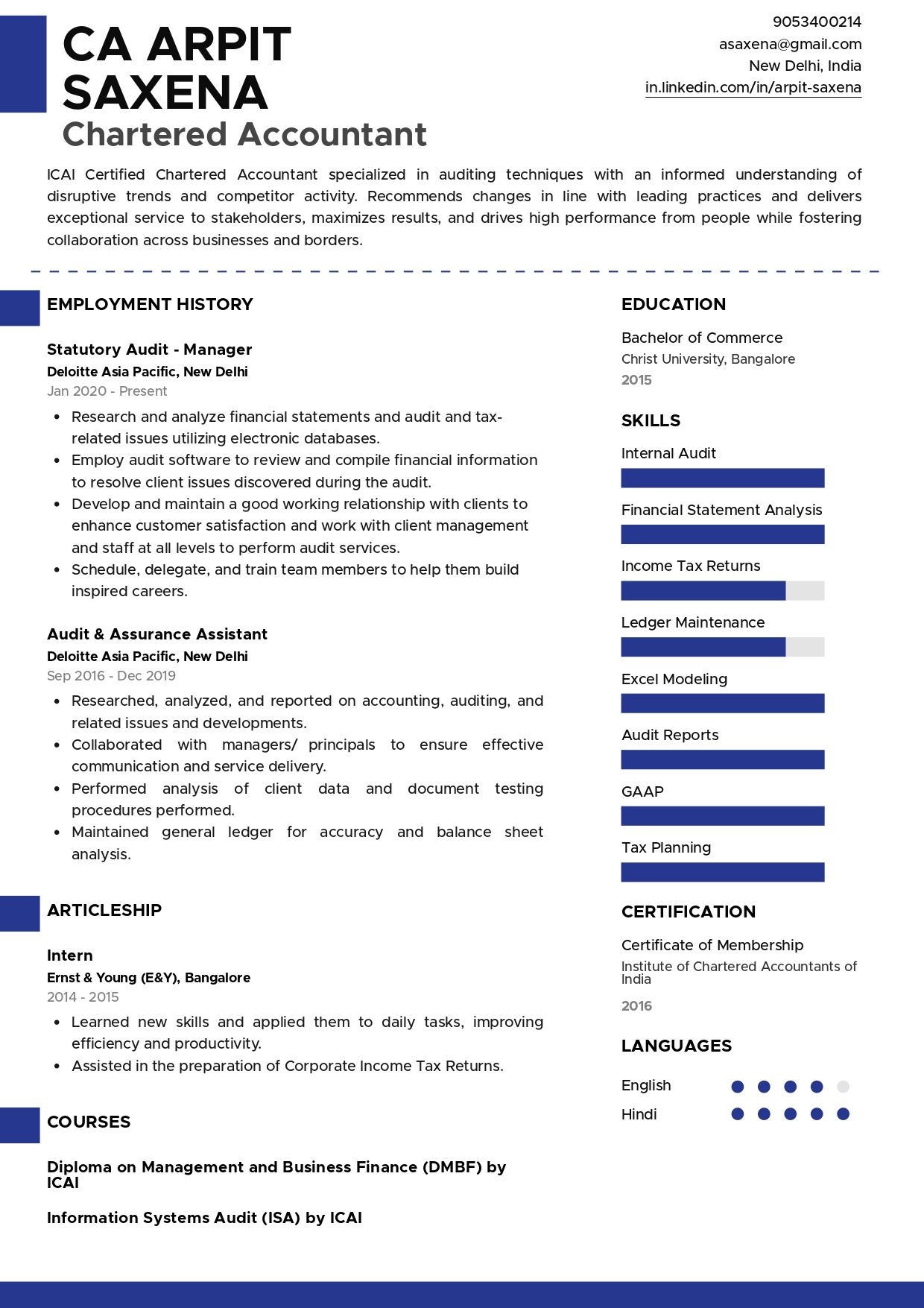

Resume of Chartered Accountant

Check the full resume of chartered accountant in text format here.

Resume of Chartered Accountant (CA)

Check the full resume of chartered accountant in text format here.

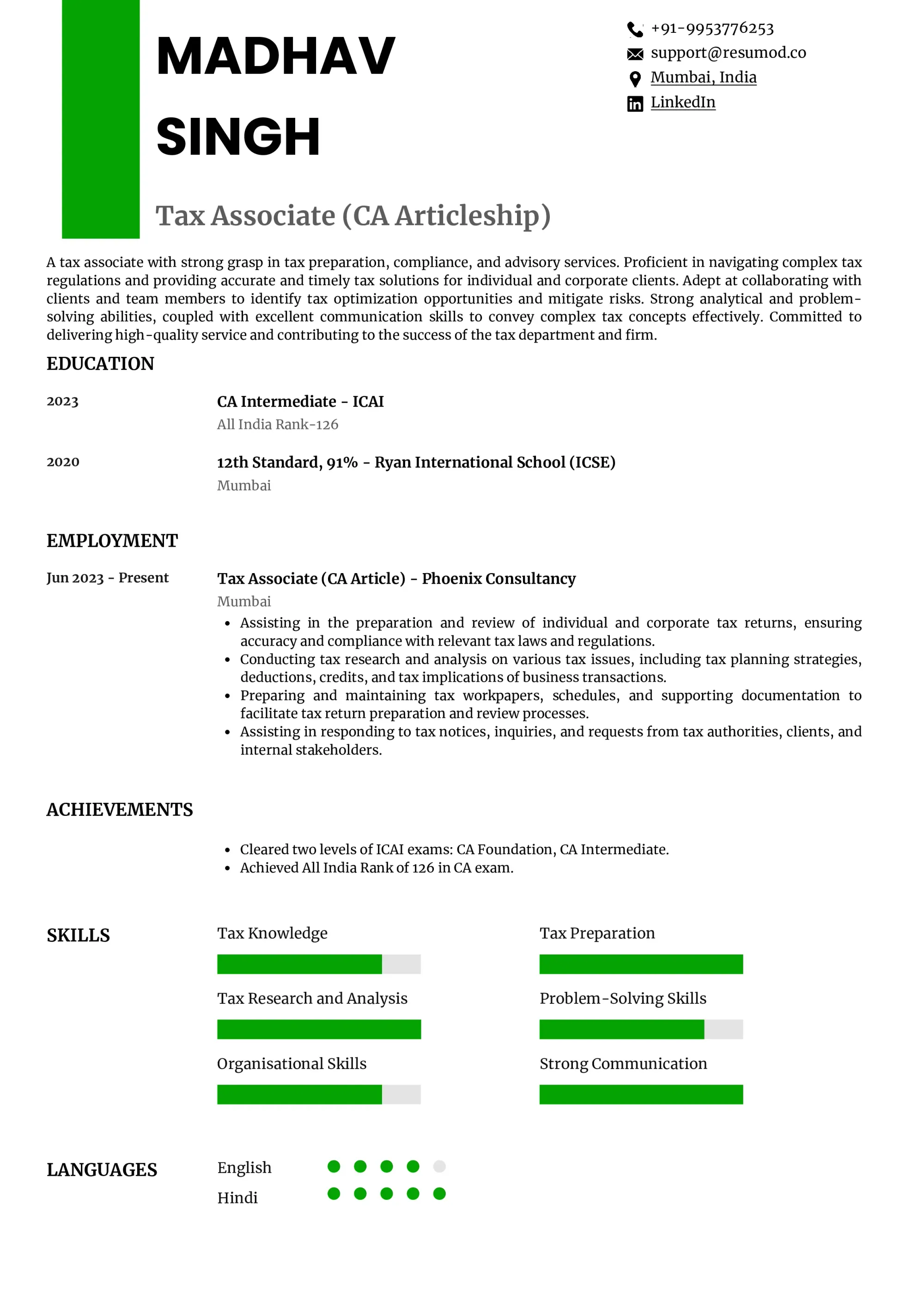

Resume of Tax Associate

Check the full resume of tax associate in text format here.

Final Words

Becoming a Chartered Accountant is a journey of dedication, perseverance, and continuous learning. Whether you want to join a Big 4 firm, start your own practice, or work in a multinational company, a CA qualification opens endless opportunities.

As industries become more tech-driven and globally connected, CAs will continue to play an essential role in shaping financial stability and growth.

Ready to start your CA journey? Take the first step today and build a career that blends finance, technology, and strategy!