Resume Skills and Keywords for GST Accountant

A tax accountant is in charge of assisting clients and businesses with financial and income tax statements. These qualified individuals conduct research, study, and interpret tax law. Preparing payments, detecting tax savings, and assessing tax difficulties are all part of their job.

Skills required for a GST Accountant role:

- Financial Statements Analysis

- Tax Returns and Filings

- GST Accounting

- Internal and External Audits

- Mergers and Acquisitions

- MS Office Suite

- Cost Accounting

- Regulatory Compliance

What recruiters look for in a GST Accountant resume:

- Gather the necessary materials, such as yearly tax tables, instructions, and forms, in order to accurately compute taxes for clients.

- Collaborate with clients to gather personal information about prospective deductions, educational grants, or allowances.

- Inform clients of the important papers and documentation required to correctly complete tax forms.

What can make your GST Accountant resume stand out:

A strong summary that demonstrates your skills, experience, and background in the accounting sector

- A certified GST practitioner with a keen eye for reviewing, investigating and correcting errors and inconsistencies in financial documents. Skilled in handling audit assignments.

Targeted job description

- Prepare tax returns, payments, paperwork, and reports as needed.

- Assess and investigate complicated tax situations in order to find solutions.

- Manage and keep the company's tax database up to date.

- Determine tax savings and offer profit-boosting strategies.

Related academic background

- B.Com | Millennium College, New Delhi 2018

- Higher Secondary| DPS, Mathura Road, New Delhi 2015

- Senior Secondary| DPS, Mathura Road, New Delhi 2013

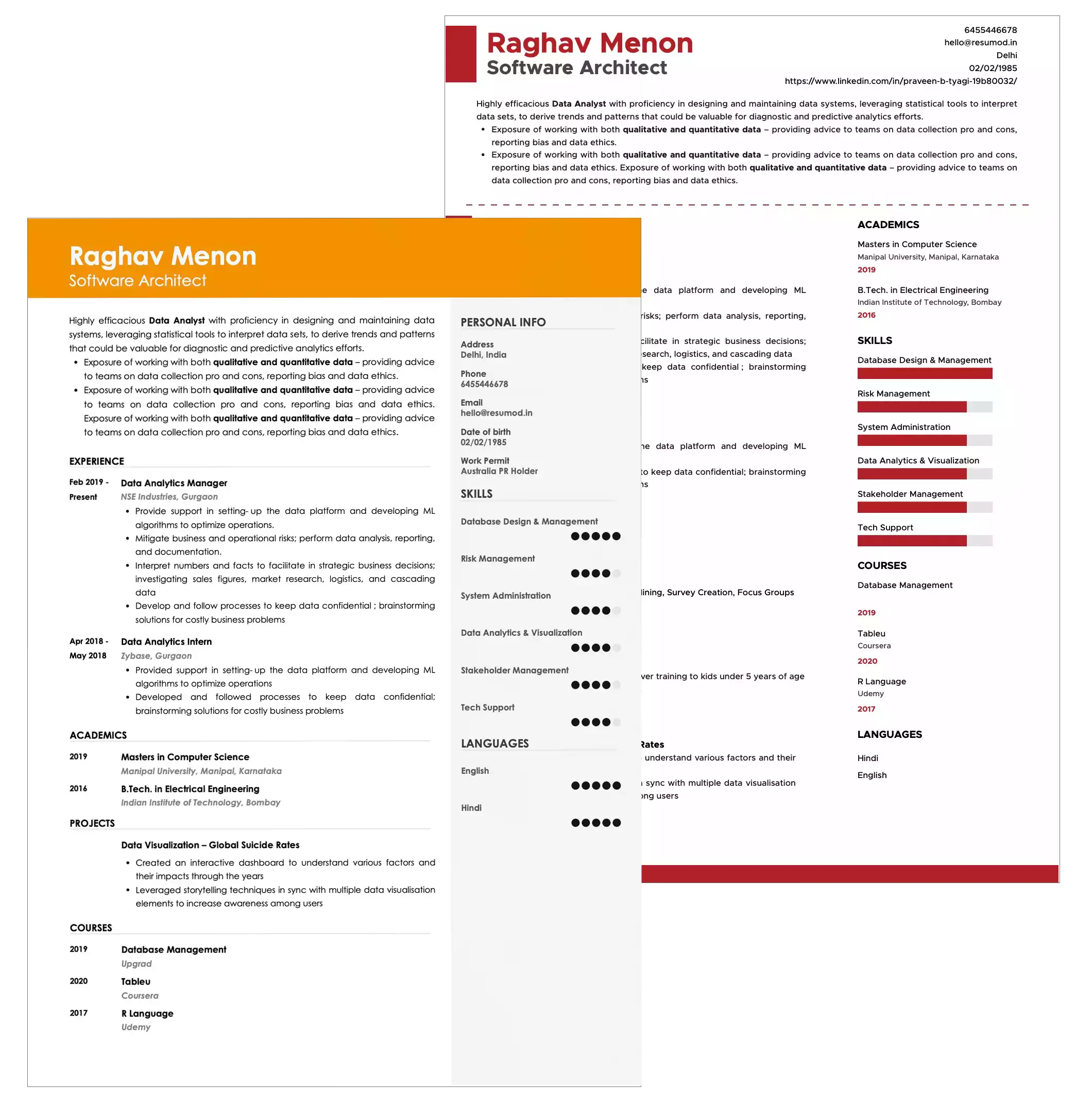

Sample Resume of GST Accountant in Text Format

RADHIKA JUNEJA

GST Accountant

Phone: 9600112222 | Address: 46/30, Ivy Street, New Delhi

Email: junejarad456@gmail.com | linkedin.com/in/radhika-juneja

SUMMARY

A certified GST practitioner with a keen eye for reviewing, investigating and correcting errors and inconsistencies in financial documents. Skilled in handling audit assignments.

EDUCATION

- B.Com

Millennium College, New Delhi 2018

- Higher Secondary

DPS, Mathura Road, New Delhi 2015

- Senior Secondary

DPS, Mathura Road, New Delhi 2013

PROFESSIONAL ENHANCEMENTS

Certifications

- Certified GST professional | 2019.

Courses

- Advanced course in tax and accounting from CA Nimish Gaba in 2018.

- Course in MS Oce Suite in 2018.

EXPERIENCE / INTERNSHIP

Accounting Intern Nimbus Pvt Ltd, New Delhi | Jun 2018 – Aug 2018

- Completed weekly check runs and prepared cash disbursement reports.

- Reviewed invoices for coding accuracy and approval.

- Investigated and resolved issues related to GST while releasing payments.

- Prepared 150 tax forms for all vendors and W-2’s for employees.

- Liaise with internal and external auditors.

Client relationship Intern RK Consultants, New Delhi | May 2017 – Jul 2017

- Generated lead by cold calls and digital marketing.

- Used scripts to provide information about society amenities, layout, price, and rules and regulations.

- Arranged business meeting with prospective clients.

- Build long-term relationships with new and existing customers.

PROJECTS

- Impact of GST on Indian Economy

- Studied the advantages and disadvantages of GST introduction on the country.

- Highly appreciated for publishing the report in 2 national journals.

SKILLS ( TECHNOLOGY / FUNCTIONAL )

GST Accounting | Internal and External Audits | Mergers and Acquisitions | MS Office Suite | Cost Accounting | Regulatory Compliance

EXTRA-CURRICULAR

Volunteering

- Volunteered for Clean India Campaign in 2016 and 2019.

- Volunteered for plant a tree Campaign in 2018

Participations / Sports

- Winner of Inter-College debate competition in 2018.

- Third prize winner in Quiz for Commerce Students organised by Harvard university in 2017.

Publications

- International Journal of Commerce, April 2017

- Conference for Research in Commerce, March 2017

Languages

- English

- Hindi

- Japanese

64429

64429