Resume Skills and Keywords for Income Tax Officer

Income Tax Officers are professionals who administer Income Tax issues pertaining to the Central Board of Direct Taxes (CBDT). Employed by the Ministry of Finance, they are primarily responsible for the evaluation and assessment of public and private income in compliance with laws and regulations.

Skills required for an Income Tax Officer role

- Process Improvement

- Price & Statistical Modelling

- Numeracy

- Federal Income Tax Laws

- Anti-Money Laundering laws

- Audit Supervision

- Cost Accounting Standards (CAS)

- Income Assessment

- Routine Compliance

- Taxation Audit Applicability

What recruiters look for in an Income Tax Officer's resume:

- Ability to evaluate the financial information of individuals, businesses, and the public.

- Demonstrated knowledge of fiduciary principles, gifting, estate, and income taxation.

- Acquaintance with Taxation systems including ITR01, ITR02, ITR03, TDS Return, and GST return Filings E- Way Bill under GST.

- Strong leadership and personnel management skills

What can make your Income Tax Officer resume stand out:

A strong summary that demonstrates your skills, experience, and background in taxation

Meticulous administrative professional experienced in technical investigative work for the Department of Revenue (DOR), Government of India. Proficiency in comprehension, analysis, interpretation, and correlation of all state tax laws, ethics, and confidentiality laws and regulations. Well-versed with taxpayer accounting and auditing systems, DOR software, and database application. Possess excellent listening, interpersonal, written, and verbal communication skills.

Targeted job description

- Assist in the revenue collection for public welfare and government administration.

- Deliver a range of tax services in compliance with laws and regulations.

- Manage tax provision and tax compliance process.

Related academic background

- Comprehensive analysis of Income-tax Amendments by Finance (No. 2) Act, 2019 from TaxGuru Edu | 2020

- Limiting Taxation Disputes from TaxGuru Edu | 2019

- Bachelor in Commerce (Hons.) from University Of Delhi, New Delhi | 2016

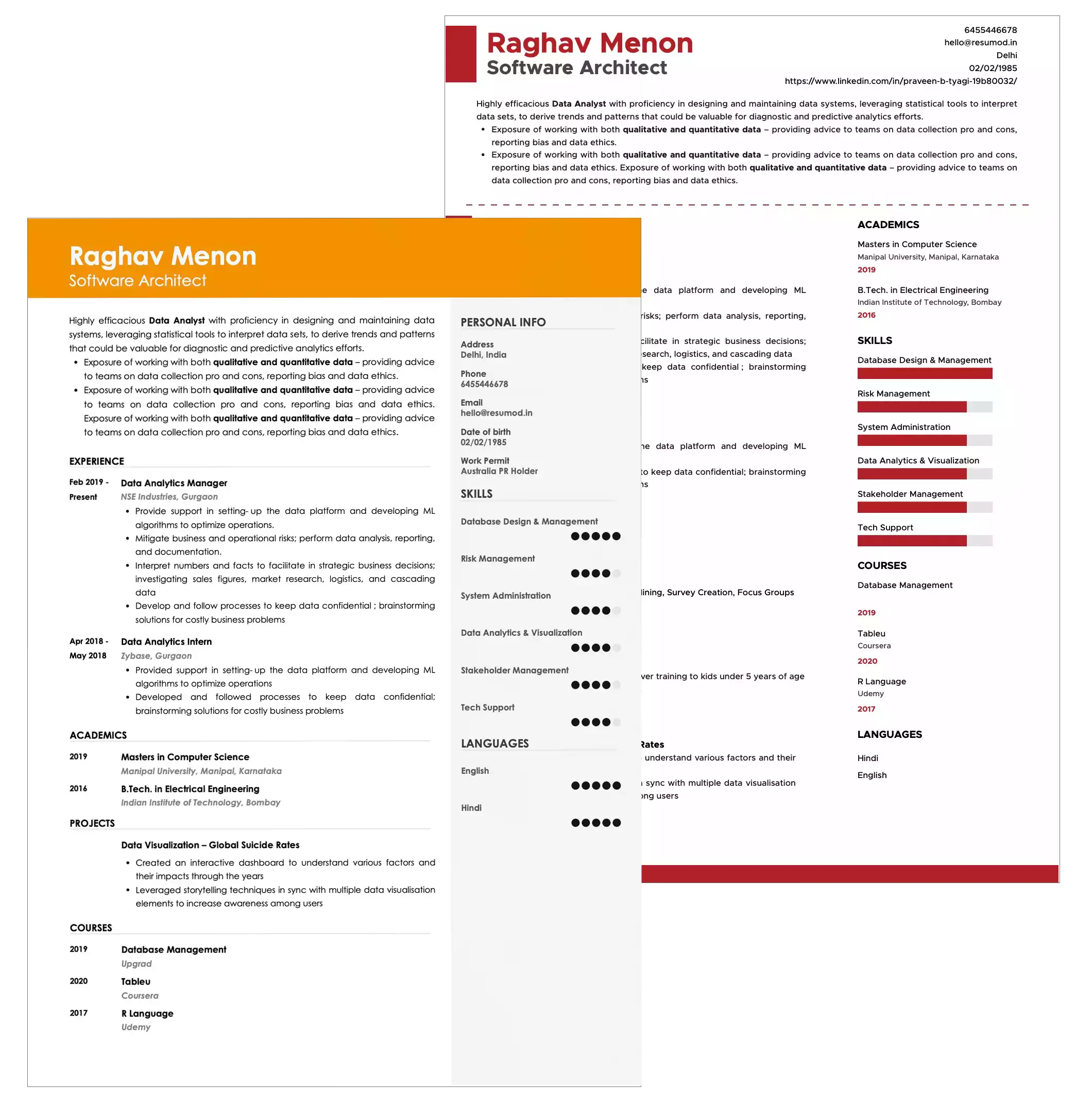

Sample Resume of Income Tax Officer in Text Format

Yuvraj Khanna

Income Tax Officer

9798599955| yuvrajkhanna2000@gmail.com | New Delhi, India | linkedin.com/in/yuvraj-khanna

SUMMARY

Meticulous administrative professional experienced in technical investigative work for the Department of Revenue (DOR), Government of India. Proficient in comprehension, analysis, interpretation, and correlation of all state tax laws, ethics, and confidentiality laws and regulations. Well-versed with taxpayer accounting and auditing systems, DOR software, and database application. Possess excellent listening, interpersonal, written, and verbal communication skills.

EXPERIENCE/INTERNSHIP

Income Tax Officer - Government of India, New Delhi | Apr 2018 - Present

- Facilitate the management of government entities by maintaining tax accounts and funds receipts.

- Supervise, train, and mentor senior associates, associates, and interns on tax projects and assess the performance of staff for engagement reviews.

- Send notifications and conduct periodic checks for embezzlement and other illegal activities and investigate charges of tax evasion.

- Ensure the legal contribution of both individuals and corporations to the authorities.

- Analyze the assets of individuals through third parties and court records to determine the authenticity of disputes, foreclosures, and income statements.

- Determine the real earnings of individuals who have submitted income tax returns.

- Executes searches targeting individuals, firms, and organizations that have filed an inaccurate income tax return (ITR) or have failed to file an ITR.

- Audit filed tax returns and supporting documentation to ensure compliance with applicable State laws.

- Review applications for credits, exemptions, lower tax rates, and penalty waivers.

COURSES

- Comprehensive analysis of Income-tax Amendments by Finance (No. 2) Act, 2019 from TaxGuru Edu | 2020

- Limiting Taxation Disputes from TaxGuru Edu | 2019

EDUCATION

- Bachelor in Commerce (Hons.) from University Of Delhi, New Delhi | 2016

SKILLS (TECHNOLOGY/FUNCTIONAL)

Process Improvement | Price & Statistical Modelling | Numeracy | Federal Income Tax Laws Anti-Money Laundering laws | Audit Supervision | Cost Accounting Standards (CAS)

LANGUAGES

English

Hindi

14424

14424