Resume Skills and Keywords for Actuarial Associate

An Actuarial Associate plays a crucial role in assessing and managing financial risks for insurance companies, pension funds, or other financial institutions. They assist in the development and maintenance of actuarial models and tools to support pricing, reserving, and financial forecasting processes. By collecting, organising, and analysing data, Actuarial Associates evaluate risk exposure and financial performance, conducting statistical analyses and preparing reports to support actuarial assumptions and methodologies. They collaborate with cross-functional teams to ensure regulatory compliance, prepare financial statements, and provide insights to support strategic decision-making within the organisation. Actuarial Associates continuously stay informed about industry trends and regulatory changes, applying relevant knowledge to improve processes and methodologies while progressing towards actuarial credentials.

Skills required for an Actuarial Associate role:

- Actuarial Principles

- Statistical Analysis

- Risk Assessment

- Excel VBA

- Mathematical Aptitude

- R Programming

- Problem-Solving Abilities

- Analytical Skills

- Strong Communication

- Adaptability

- Project Management

What recruiters look for in an Actuarial Associate resume:

- Progress toward actuarial credentials (e.g., SOA, CAS) is preferred.

- Strong analytical and quantitative skills, with proficiency in statistical analysis software (e.g., SAS, R, Python).

- Excellent problem-solving abilities and attention to detail, with the ability to interpret and communicate complex technical concepts effectively.

- Proficiency in Microsoft Excel and other office productivity tools.

- Prior internship or work experience in actuarial or related fields is advantageous.

What can make your Actuarial Associate resume stand out:

A strong summary that demonstrates your skills, experience and background in the actuarial science

- A dynamic Actuarial Associate with a strong commitment of driving revenue growth and expanding market reach. With a keen understanding of market dynamics and customer needs, leverages a consultative approach to uncover opportunities, overcome objections, and close deals effectively. Highly motivated and target-oriented, thriving in dynamic environments leveraging, proactive mindset and persuasive abilities to achieve and exceed sales targets.

Targeted job description

- Collect, organise, and analyse data from various sources to assess risk exposure and evaluate financial performance.

- Conduct statistical analyses and interpret results to support actuarial assumptions and methodologies.

- Prepare and present reports summarising findings, insights, and recommendations to stakeholders, including management, regulators, and clients.

- Assist in the preparation of financial statements, regulatory filings, and other compliance requirements in accordance with relevant accounting standards and regulatory guidelines.

- Collaborate with cross-functional teams, including underwriting, finance, and risk management, to support business initiatives and strategic decision-making.

Related academic background

- B.Sc in Maths at SRM University, Chennai | Pursuing

Sample Resume of Actuarial Associate in Text Format

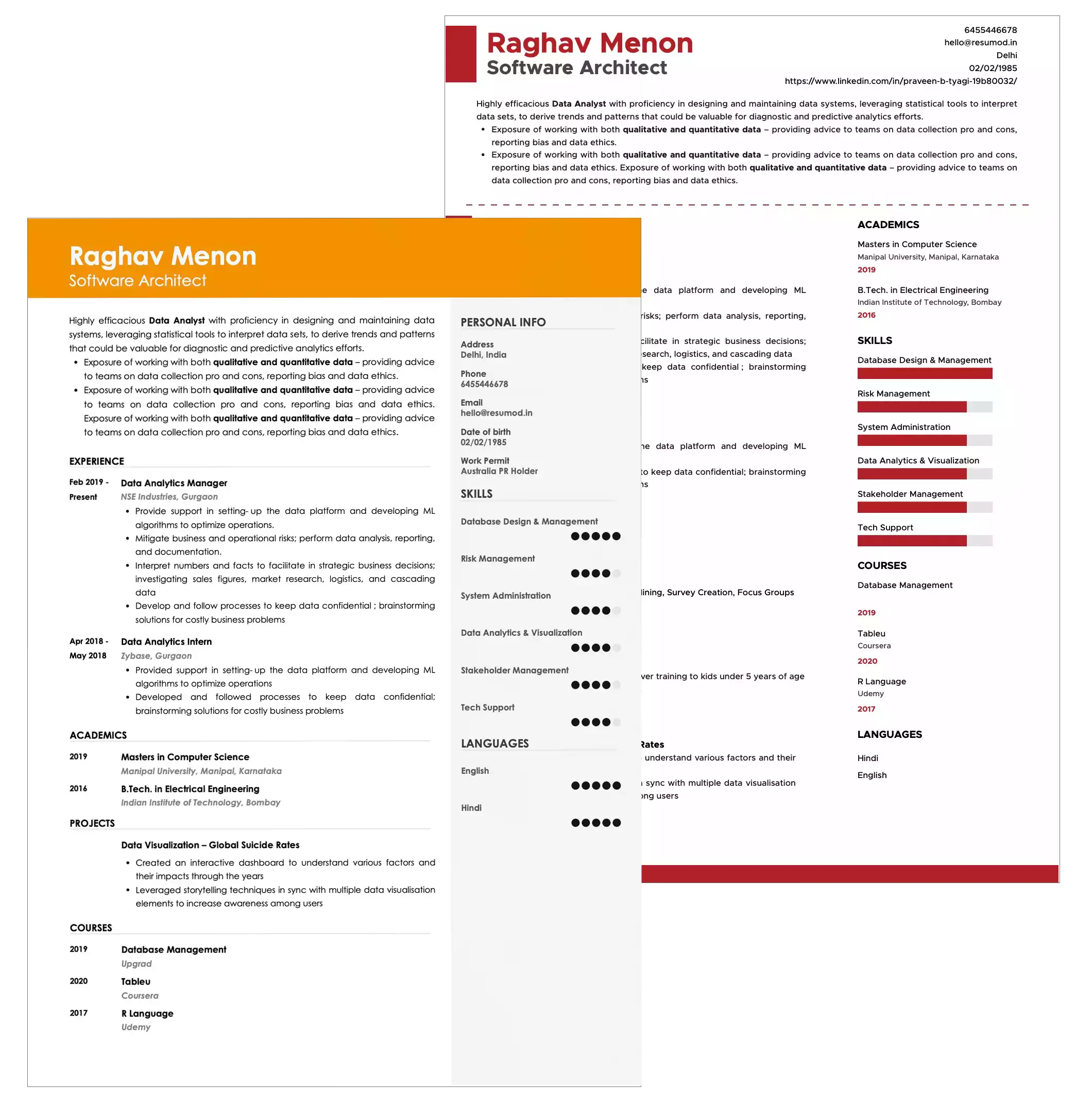

GURPREET SINGH

Actuarial Associate

+91-9953776253 | support@resumod.co |Chennai, India

SUMMARY

An analytically-driven actuarial associate with a solid foundation in actuarial science, statistical analysis, and financial modelling. Skilled in assessing insurance risks, conducting pricing analyses, and providing strategic insights to drive business decisions. Proficient in utilising actuarial methodologies and statistical tools to analyse complex data sets and derive actionable insights while applying quantitative skills and strategic thinking to solve complex problems and contribute to organisational success.

EMPLOYMENT HISTORY

Intern Actuarial Associate at KPMG from Sep 2023 - Present, Chennai

- Conducting actuarial analyses and calculations to assess insurance risks, determine pricing strategies, and support financial forecasting.

- Performing reserve valuations, experience studies, and other actuarial assessments to ensure accuracy and compliance with regulatory requirements.

- Analysing data trends, market dynamics, and competitive landscapes to identify opportunities and risks and make recommendations for business optimisation.

- Preparing reports, presentations, and other materials to communicate actuarial findings and recommendations to internal stakeholders and external partners.

- Participating in the development and enhancement of actuarial tools, methodologies, and processes to improve effectiveness.

CERTIFICATION

- Certification of Advance Excel as part of data science consisted of Excel Basics,

- Data Visualization with Excel, Advanced Ecel, and Final Project modules.

COURSES

Data Science and Analytics at Coursera | Pursuing

EDUCATION

B.Sc in Maths at SRM University, Chennai | Pursuing

SKILLS

Actuarial Principles | Statistical Analysis | Risk Assessment | Excel VBA | Mathematical Aptitude | R Programming | Problem-Solving Abilities | Analytical Skills | Strong Communication

LANGUAGES

English

Hindi

10535

10535