Resume Skills and Keywords for Financial Risk Analyst

A Financial Analyst plays a crucial role in helping organizations make informed financial decisions by analyzing market trends, financial statements, and risk factors. They assess investment opportunities, develop financial models, and provide strategic insights to optimize profitability and minimize financial risks. Financial Analysts collaborate with management teams to evaluate budgeting, forecasting, and financial planning processes. They use data-driven approaches and analytical tools to interpret complex financial data, guiding businesses in making sustainable financial decisions. Additionally, they ensure compliance with industry regulations and contribute to the development of risk management frameworks.

Skills required for a Financial Analyst role:

- Financial Analysis & Reporting

- Budgeting & Forecasting

- Risk Assessment & Mitigation

- Financial Modeling

- Investment & Portfolio Management

- Market & Credit Risk Analysis

- Data Analytics & Statistical Analysis

- Regulatory Compliance (Basel III, SEBI, RBI)

- Stress Testing & Scenario Analysis

- Stakeholder Communication

- Business Valuation

- Mergers & Acquisitions Analysis

- Corporate Finance Strategy

- Performance Metrics & KPI Tracking

What recruiters look for in a Financial Analyst's resume:

- Strong analytical and quantitative skills, with the ability to interpret financial data and generate actionable insights.

- Proficiency in financial modeling, forecasting, and investment analysis.

- Experience with financial risk management, compliance regulations, and industry standards.

- Strong attention to detail, problem-solving abilities, and a results-driven mindset.

- Knowledge of data analysis tools such as Python, R, SQL, Tableau, and Excel (VBA).

- Effective communication and presentation skills to convey financial findings to senior management and stakeholders.

What can make your React developer resume stand out:

A strong summary that demonstrates your skills, experience, and background in financial risk analysis

- Results-driven Financial Risk Analyst with 7 years of experience in identifying, analyzing, and mitigating financial risks across diverse industries. Skilled in quantitative risk assessment, financial modeling, and regulatory compliance. Proven ability to develop risk management strategies that optimize financial performance and safeguard organizational assets.

Targeted job description:

- Conduct comprehensive financial analysis and risk assessment to support strategic decision-making.

- Develop and maintain financial models to predict market trends and investment risks.

- Monitor economic indicators, industry regulations, and market dynamics to optimize financial planning.

- Provide financial insights and reports to senior management, aiding in investment and budgeting strategies.

- Implement risk management frameworks to mitigate financial vulnerabilities and ensure regulatory compliance.

- Collaborate with crossfunctional teams to improve financial reporting and data analytics processes.

Related academic background

- MBA in Finance from Amity University, Ahmedabad | 2016

- B.Com in Finance from the University of Mumbai | 2014

- Chartered Financial Analyst CFA Level II

- Financial Risk Manager FRM Certified

Sample Resume of Financial Risk Analyst in Text Format

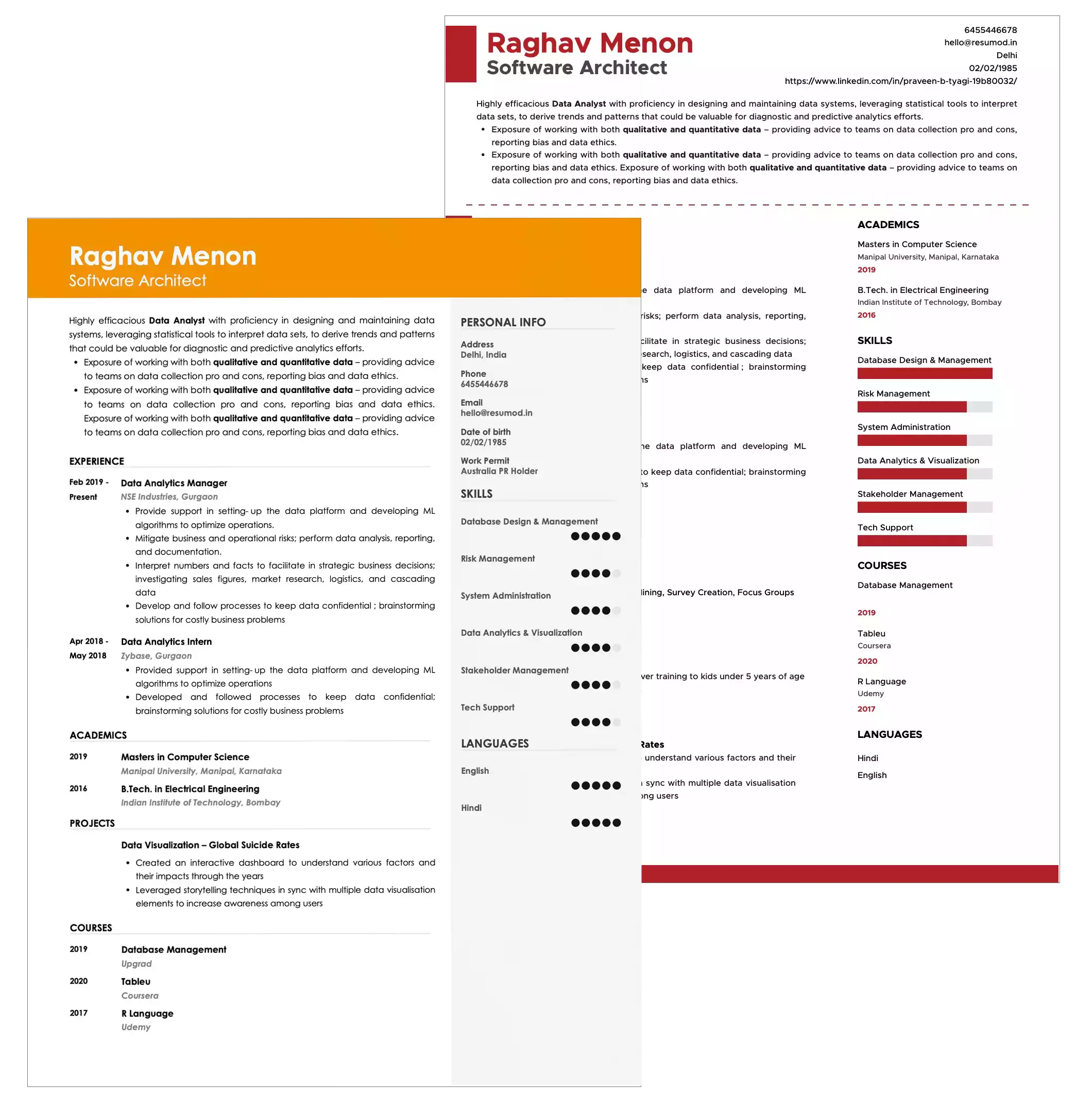

Amit Sharma

Financial and Risk Analyst

+919876543210 | support@resumod.co | linkedin.com/company/resumod

PROFESSIONAL SUMMARY

Results-driven Financial Risk Analyst with 7 years of experience in identifying, analyzing, and mitigating financial risks across diverse industries. Skilled in quantitative risk assessment, financial modeling, and regulatory compliance. Proven ability to develop risk management strategies that optimize financial performance and safeguard organizational assets.

EMPLOYMENT HISTORY

Senior Financial Risk Analyst

ICICI Bank | Jan 2020 - Present | Mumbai, India

- Conducted comprehensive risk assessments and stress tests to evaluate market, credit, and operational risk.

- Developed and implemented risk models to predict financial vulnerabilities and enhance risk mitigation strategies.

- Monitored regulatory changes and ensured compliance with financial risk management frameworks.

- Collaborated with cross-functional teams to develop data-driven financial strategies.

Presented risk reports and insights to senior management for strategic decision-making.

Projects & Achievements

- Led a project that reduced credit risk exposure by 15% through enhanced risk modeling.

- Developed an automated financial risk dashboard, reducing reporting time by 30%.

- Successfully implemented a regulatory compliance framework aligning with RBI and SEBI standards.

Financial Risk Analyst

HDFC Asset Management Company | Jul 2016 - Dec 2019 | Mumbai, India

- Analyzed financial statements, market trends, and economic indicators to assess investment risks.

- Assisted in developing risk management frameworks for asset allocation and portfolio optimization.

- Conducted stress testing and sensitivity analysis to measure potential financial impacts.

- Created reports and dashboards to visualize risk metrics and key performance indicators.

- Provided recommendations to mitigate exposure to credit and market risks.

EDUCATION

MBA in Finance from Amity University, Ahmedabad | 2016

B.Com in Finance from the University of Mumbai | 2014

SKILLS

Financial Analysis & Reporting, Budgeting & Forecasting, Risk Assessment & Mitigation, Financial Modeling, Investment & Portfolio Management, Market & Credit Risk Analysis, Data Analytics & Statistical Analysis, Regulatory Compliance (Basel III, SEBI, RBI), Stress Testing & Scenario Analysis,

LANGUAGES

English | Hindi

72192

72192