Resume Skills and Keywords for Investment Banker

An investment banker is responsible for providing financial advisory services to corporations, governments, and other institutions. Their primary roles include analysing financial data, conducting valuation assessments, and structuring deals for mergers, acquisitions, and capital raising. Investment bankers build and maintain client relationships, offering tailored financial solutions to meet specific objectives. They stay informed about market trends, conduct due diligence, and navigate negotiations to secure favourable terms for transactions. Additionally, investment bankers must ensure regulatory compliance, manage financial risks, and deliver persuasive presentations to win new business.

Skills required for an Investment Banker role

- Financial Modelling

- Valuation Techniques

- Comparable Company Analysis (CCA)

- Quantitative Analysis

- Deal Execution

- Market Research

- Strategic Analysis

- Risk Management

- Analytical Skills

- Strong Communication

- Project Management

- Leadership Skills

- Adaptability

What recruiters look for in an Investment Banker resume:

- Bachelor's degree in finance, business, or a related field.

- Strong analytical skills and proficiency in financial modelling.

- Excellent communication and presentation skills.

- Ability to work in a fast-paced and dynamic environment.

- Understanding of financial markets, regulations, and economic trends.

What can make your Investment Banker resume stand out:

A strong summary that demonstrates your skills, experience and background in investment banking

- A seasoned Investment Banker with a successful record of executing complex financial transactions and providing strategic advisory services. With a meticulous approach to financial modelling and a deep understanding of industry dynamics, consistently delivers tailored solutions that meet client objectives and drive value for the organisation.

Targeted job description

- Determine the value of companies, assets, or securities through various valuation methods, such as discounted cash flow (DCF), comparable company analysis (CCA), and precedent transactions.

- Work on the structuring of financial transactions, including mergers and acquisitions (M&A), initial public offerings (IPOs), and other capital-raising activities.

- Participate in negotiations with clients, potential investors, and other stakeholders to secure favourable terms for financial transactions.

- Evaluate and manage financial risks associated with investment banking activities.

- Develop strategies to mitigate risks and enhance the overall success of transactions.

Related academic background

- MBA in Finance at SP Jain Institute of Management and Research, Mumbai | 2019

- BBA in Finance at University of Mumbai, Mumbai | 2017

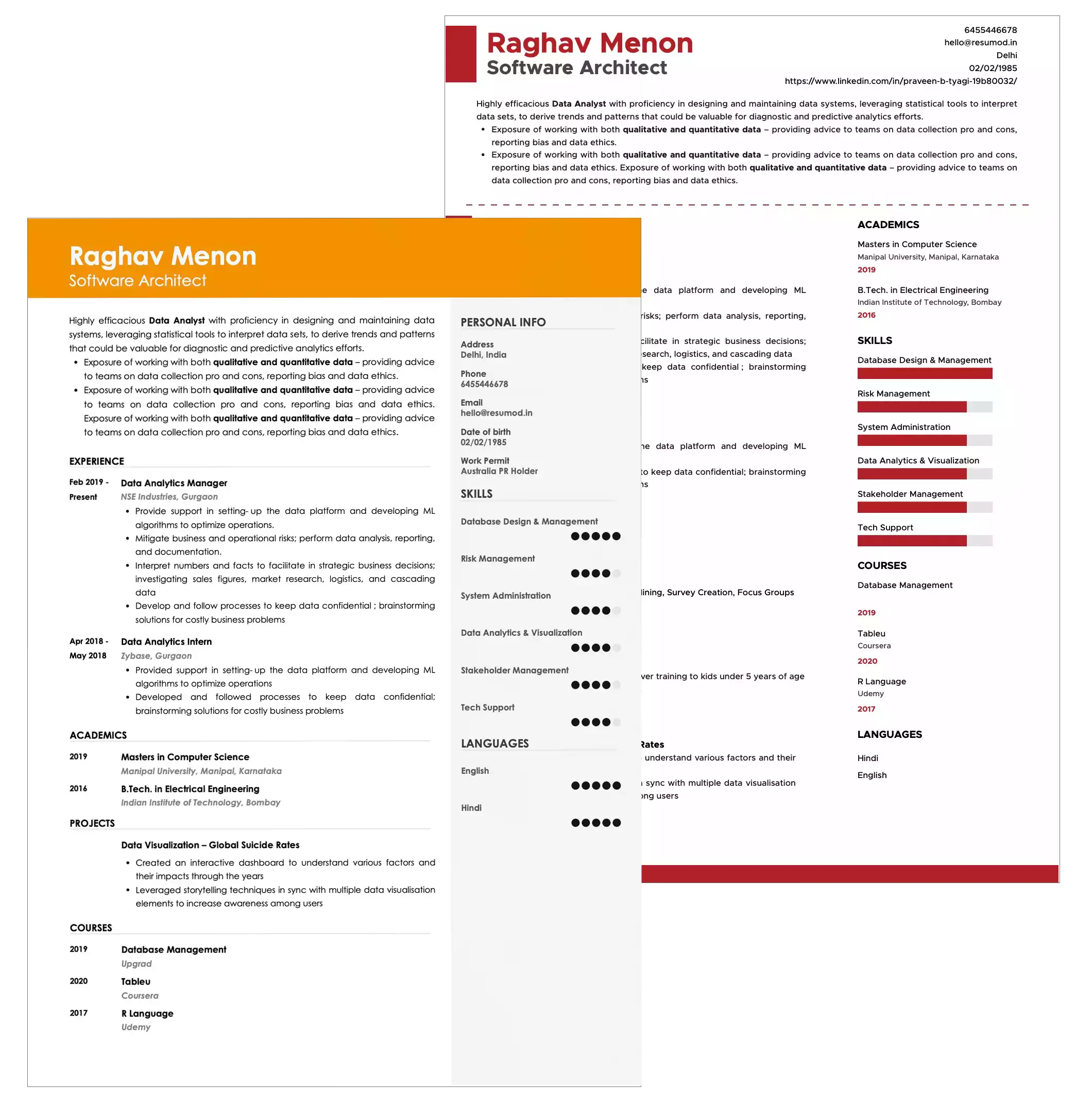

Sample Resume of Investment Banker in Text Format

ANKUR BHAJPAI

Investment Banker

+91-9953776253 | support@resumod.co |Mumbai, India

SUMMARY

A seasoned Investment Banker with a successful record of executing complex financial transactions and providing strategic advisory services. With a meticulous approach to financial modelling and a deep understanding of industry dynamics, consistently delivering tailored solutions that meet client objectives and drive value for the organisation.

EMPLOYMENT HISTORY

Investment Banker at Goldman Sachs from Aug 2021 - Present, Mumbai

- Conducting detailed financial modelling, valuation, and analysis to assess the financial viability of potential transactions.

- Evaluating the financial performance and risk factors of companies involved in transactions.

- Identifying and analysing potential investment opportunities or clients for M&A, capital markets, and other financial transactions.

- Building and maintaining relationships with clients, institutional investors, and other stakeholders.

- Providing strategic financial advice to clients on mergers, acquisitions, divestitures, and other corporate finance matters.

- Developing and presenting compelling investment proposals to potential investors.

- Coordinating and managing due diligence processes for transactions, ensuring comprehensive analysis and risk assessment.

Associate Investment Banker at Morgan Stanley from Apr 2019 - Jul 2021, Mumbai

- Conducted sensitivity analyses and stress testing to assess potential impacts on transaction outcomes.

- Ensured adherence to regulatory requirements and internal policies during the deal process.

- Prepared market reports and analyses to support client pitches and transaction strategies.

- Assisted in building and maintaining client relationships through effective communication and understanding of client needs.

- Contributed to the preparation of client pitches, proposals, and presentations.

PROJECTS

Risk Management in Banking | 2019

- Analysed and proposed strategies for effective risk management in the banking sector, considering regulatory changes and market trends.

- Evaluated the financial performance of a specific banking firm over the past decade, considering key financial ratios and indicators.

EDUCATION

MBA in Finance at SP Jain Institute of Management and Research, Mumbai | 2019

BBA in Finance at University of Mumbai, Mumbai | 2017

SKILLS

Financial Modelling | Valuation Techniques | Comparable Company Analysis (CCA) | Quantitative Analysis | Deal Execution | Market Research | Strategic Analysis | Risk Management | Analytical Skills

LANGUAGES

English

Hindi

Marwadi

9369

9369