Resume Skills and Keywords for Hedge Fund Manager

A Hedge Fund Financial Analyst plays a critical role in analysing and estimating financial data to support investment decisions within a hedge fund. Their responsibilities include conducting thorough financial modelling, assessing market trends, and utilising quantitative techniques to develop forecasts and projections. The analyst collaborates with portfolio managers, risk managers, and other stakeholders to provide insights into potential investment opportunities, assess risks, and contribute to overall fund strategy.

Skills required for a Hedge Fund Manager role:

- Financial Market Analysis

- Investment Strategy

- Risk Management

- Hedging Techniques

- Portfolio Management

- Market Trends

- Asset Allocation

- Quantitative Analysis

- Data Interpretation

- Regulatory Compliance

- Strong Communication

- Adaptability

- Supervision

What recruiters look for in a Hedge Fund Manager resume:

- Bachelor's or Master's degree in Finance, Economics, Business, or a related field.

- Proven experience in hedge fund management or a related investment management role.

- Excellent knowledge of financial markets, investment principles, and risk management.

- Effective leadership, communication, and interpersonal skills.

What can make your Hedge Fund Manager resume stand out:

A strong summary that demonstrates your skills, experience and background in financial management

- A judicious hedge fund manager with an unparalleled performance history in volatile financial markets. Equipped with the ability to comprehend investing tactics, risk mitigation, and financial market patterns, having effectively guided top-performing groups to maximise portfolio efficacy.

Targeted job description

- Conduct in-depth research to identify investment opportunities and potential risks.

- Monitor the fund's performance and evaluate the success of investment strategies.

- Generate regular reports for stakeholders, providing insights into fund performance.

- Implement risk mitigation strategies and ensure compliance with risk management policies.

- Develop and implement investment strategies aligned with the fund's objectives and risk tolerance.

- Make informed investment decisions based on thorough market analysis, economic trends, and risk assessments.

Related academic background

- MBA in Finance at Indian Institute of Management, Udaipur | 2022

- BBA in Finance at Mohanlal Sukhadia University, Udaipur | 2020

Sample Resume of Hedge Fund Manager in Text Format

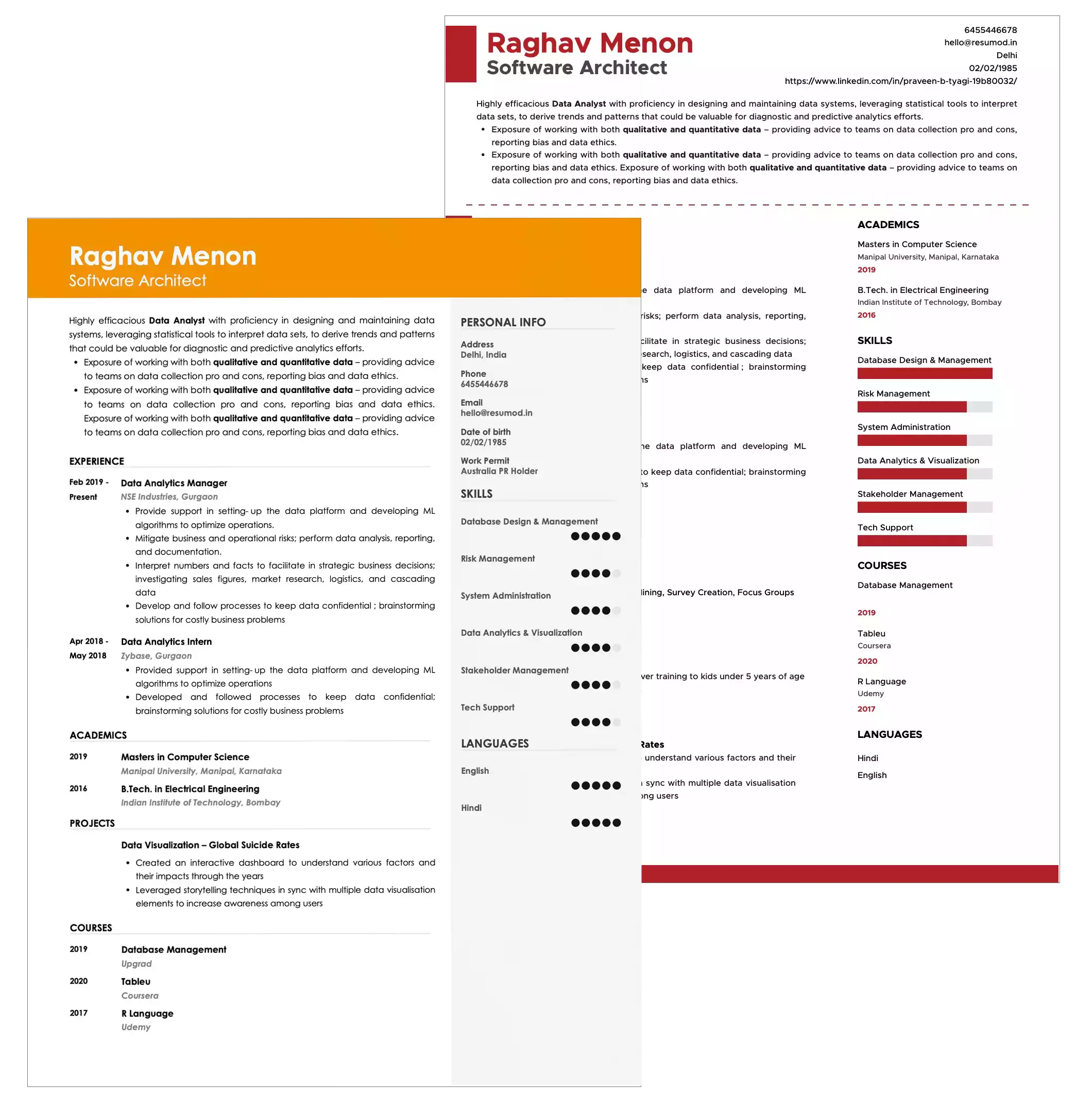

GAURAV DAVE

Hedge Fund Manager

+91-9876543210 | gaurav@gmail.com |Udaipur, India

SUMMARY

A judicious hedge fund manager with an unparalleled performance history in volatile financial markets. Equipped with the ability to comprehend investing tactics, risk mitigation, and financial market patterns, having effectively guided top-performing groups to maximise portfolio efficacy.

EMPLOYMENT HISTORY

Hedge Fund Manager at Hindustan Zinc from Apr 2022 - Present, Udaipur

- Develop and implement investment strategies in line with fund objectives and market conditions.

- Conduct market analysis to identify opportunities and risks.

- Implement effective risk management practices to safeguard fund assets. Review offering documents or marketing materials to ensure regulatory compliance.

- Oversee the construction and management of investment portfolios, and select specific investments or investment mixes for purchase by an investment fund.

- Monitor and adjust portfolio allocations to optimise risk-adjusted returns.

- Conduct due diligence on potential investments and assess their alignment with fund goals.

- Collaborate with marketing teams to develop fund marketing materials.

- Communicate fund performance, investment strategies, and market outlook.

EDUCATION

MBA in Finance at Indian Institute of Management, Udaipur | 2022

BBA in Finance at Mohanlal Sukhadia University, Udaipur | 2020

CERTIFICATION

Certified Finance Planner (CFP)

SKILLS

Financial Market Analysis | Investment Strategy | Risk Management | Hedging Techniques | Portfolio Management | Market Trends | Asset Allocation | Quantitative Analysis | Data Interpretation | Regulatory Compliance

LANGUAGES

English

Hindi

11229

11229