Resume Skills and Keywords for KYC Analyst

A KYC analyst's main responsibilities include reviewing new client account documents, evaluating high-risk accounts, and analyzing new customer processes and regulations. They also do internal research on market trends and client behavior patterns. KYC analysts may also be involved in the examination of new product proposals as well as the analysis of risk and compliance problems associated with these goods. KYC analysts are typically employed by banks or other financial institutions, however, they can also work in other industries such as manufacturing, technology, or consulting.

Skills required for a KYC Analyst role

- Lending Regulations

- High-Risk Account Reviews

- Data Collection and Analysis

- Risk Assessment Procedures

- Customer Handling

- Administration Support

- Documentation Review

- Customer Due Diligence

- Business Flair

- Marketing Expertise

- Research Skills

What recruiters look for in a KYC Analyst resume:

- Strong competencies in performing detailed data gathering and analysing the gathered data.

- Skills in ensuring KYC checks and completing Enhanced Due Diligence.

- Ability to enforce compliance with regulations and attain client-specific processing requirements

What can make your KYC Analyst resume stand out:

A strong summary that demonstrates your skills, experience, and background as KYC Analyst.

- Meticulous KYC Analyst with over 8 years of experience in consistent application of local and global KYC policies and procedures, aimed at assuring compliance with relevant money-laundering regulations. Ensures that clients’ data is accessible at all times, regardless of the location. Ability to implement strategies to determine inconsistencies in clients’ accounts.

Targeted job description

- Prevent money laundering, terrorist financing, and other illegal activities.

- Collect the most accurate data for compliance purposes.

- Develop and implement a streamlined process of KYC and AML data collection, reporting, and tracking.

Related academic background

- Bachelor of Commerce | Christ University 2011 - 2014

Sample Resume of KYC Analyst in Text Format

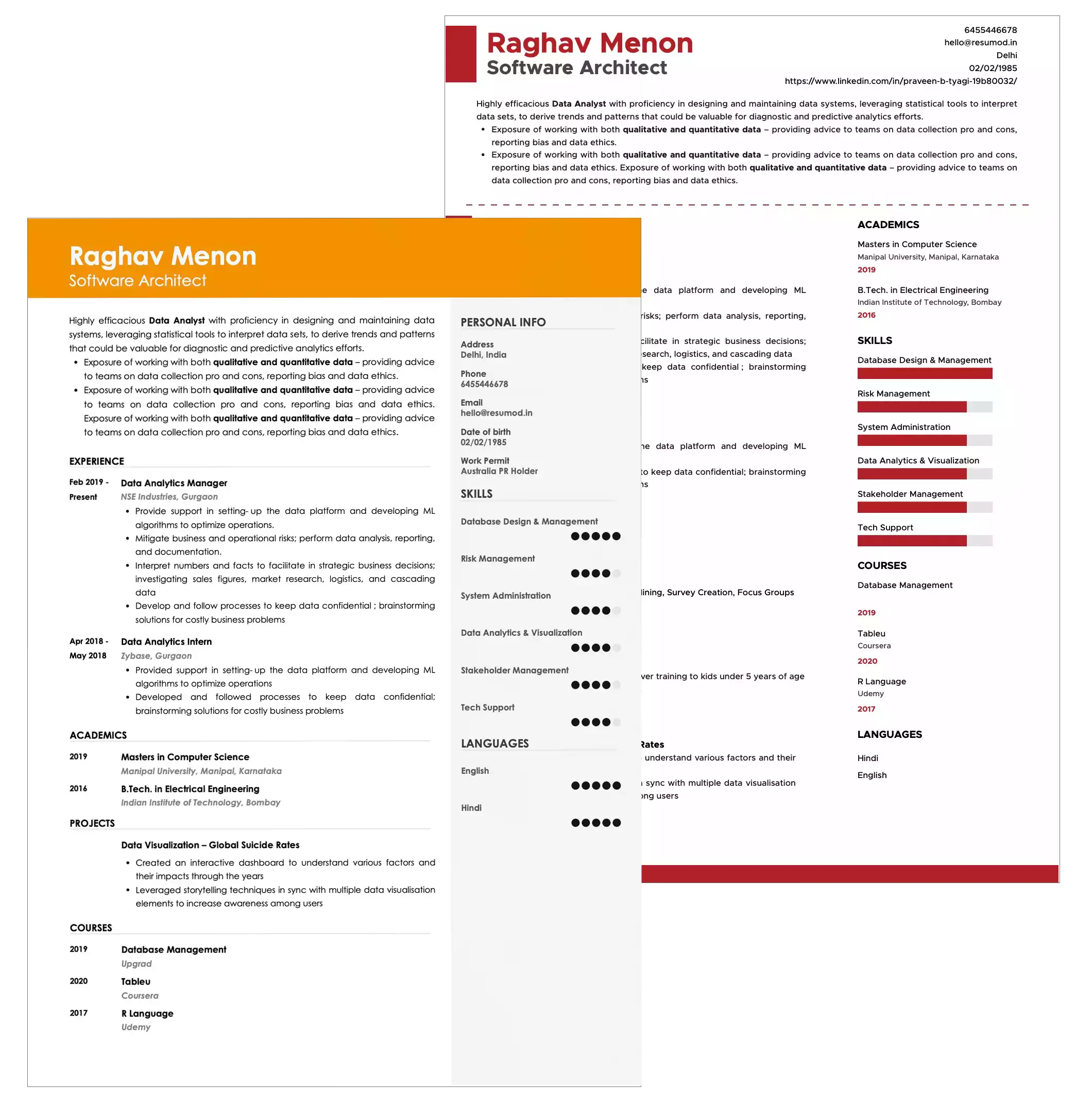

Monica Sharma

KYC Analyst

+919876852674 | monicasharma@gmail.com | https://www.linkedin.com/in/monica-sharma-98/

Summary

Meticulous KYC Analyst with over 8 years of experience in consistent application of local and global KYC policies and procedures, aimed at assuring compliance with relevant money-laundering regulations. Ensures that clients’ data is accessible at all times, regardless of the location. Ability to implement strategies to determine inconsistencies in clients’ accounts.

EMPLOYMENT

KYC Analyst | JLL, Greater Noida 2018 - 2021

- Interpreted and applied anti-money laundering regulations to identify and recommend compliance changes as appropriate.

- Collected and examined financial statements and documents to assist in identifying unusual transaction patterns. Conducted due diligence searches in various third-party and internal databases.

- Implemented and maintained appropriate KYC and enhanced due diligence compliance standards.

KYC Analyst | Barclays, Greater Noida 2016 - 2018

- Coordinated with internal partners such as Front, Middle, and Back Office staff to obtain required information and applicable documentation related to client on-boarding and KYC production.

- Initiated and completed high-quality KYC files inclusive of data input, research, and analysis.

- Identified data anomalies and assisted with root cause analysis to minimize errors.

- Maintained detailed tracking of KYC file status and other customer record activities to ensure completion within required timeframes.

- Independently managed multiple simultaneous requests inclusive of customer data maintenance in a high-pressure work environment.

AML Analyst | Congile, Delhi 2014 - 2016

- Implemented AML monitoring and transferring system.

- Performed periodic file reviews ensuring activities are reviewed in a holistic manner across the spectrum of products and services used by the customer.

- Ensured CDD is properly performed by the LOBs and EDD is applied in cases where warranted to mitigate AML/TF.

- Analyzed large quantities of information, identifying trending including establishing appropriate metrics to determine changing risk elements.

EDUCATION

Bachelor of Commerce | Christ University 2011 - 2014

SKILLS

Lending Regulations | High-Risk Account Reviews | Data Collection and Analysis | Risk Assessment Procedures | Customer Handling | Administration Support | Documentation Review | Customer Due Diligence

LANGUAGES

English | Tamil | Spanish

COURSES

Financial Analysis and Financial Modeling using MS Excel

39504

39504